This question of how much to retire is difficult to answer as people retire at different times with different personal and financial circumstances. You also don’t know how long you will live in retirement.

The page looks at information and research papers regarding funding an income in retirement and is factual in nature which means it does not consider your personal circumstances (ie you may require different retirement age, income and capital amounts to reach your retirement goals).

If you require personal advice you must speak with a qualified financial planner and should not use this page as the basis of making retirement decisions. You can use the menu bar at the top of website to click on state and then city to find a qualified financial planner close to you.

You can also use the FPA find a planner link if you are not near a capital city https://fpa.com.au/find-a-planner/

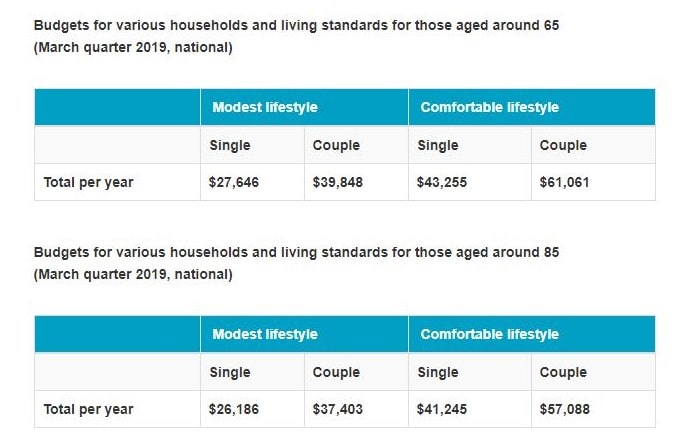

Each year The Association of Superannuation Funds of Australia (AFSA) publishes retirement standards calculating what would be considered a modest and comfortable lifestyle income in retirement.

Both budgets assume that the retirees own their own home outright and are relatively healthy.

For those aged 65 the results are below for Mach 2019 quarter for single and couple.

The figures assume that the retiree(s) own their own home and relate to expenditure by the household. This can be greater than household income after income tax where there is a drawdown on capital over the period of retirement. Single calculations are based on female figures.

Source : superannuation.asn.au

The chart below from super Guru breaks this down into actual day to day impacts of income levels and lifestyle in retirement.

Source: superguru.com.au

As you can see there are large lifestyle impacts across a comfortable, modest or age pension only retirement.

People have different ages of retirement, as well as different personal and financial circumstances which influence the decision. It is also difficult to tell how many years you have left after your retirement, so the decision of how much you need to retire is personal. Should you need personal advice in retirement, consult a financial planner qualified to help in matters of retirement decisions, depending on the state you reside in.

Your personal and financial circumstances aside, this article contains facts that aim to guide you on information and research regarding funding a retirement income. Should you need a personal adviser, you can use FPA to find a planner link if you don’t reside near a capital city. For personal advice, use the menu bar on the website’s top to find a qualified financial planner in your city and state, but don’t use this page as a basis of making major The information provided is factual, meaning that you may need different figures of income, capital amounts, as well as a different retirement age to achieve your retirement goals.

The Association of Superannuation Funds of Australia( AFSA) publishes updated retirement standards annually. These standards guide in the calculation of what is measured as a comfortable and modest lifestyle income upon retirement: assuming that the retirees are relatively healthy and they are owners to their home's outright.

If you are 65, the results and figures for single and couples are determined as long as the retirees are legal owners of their home and that they relate to expenditure by the household. The single calculations focus on the female retirees, and they can be greater than household income as there is a drawback on capital over the retirement period.

According to research from Super Guru, the actual day to day impacts of lifestyle is larger across a modest, comfortable, and age pension only retirement. This means that lifestyle and income levels are very instrumental in retirement.

Source: superannuation.asn.au

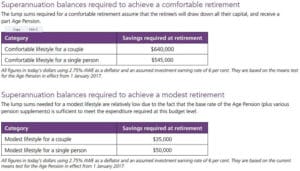

The AFSA (Association of Superannuation Funds of Australia) has made a calculation of the necessary superannuation balances for retirees aged around 65 to help them attain their incomes. When it comes to assets, it is assumed that all capital is drawn down by the end of the retirement period. This is exclusive of personal assets and the family home, which doesn't leave much superannuation for beneficiaries.

The calculations factoring in Centrelink Age Pension assumes that, for instance, a couple wanting a comfortable income upon retirement would need a superannuation of $545,000 at least for every person. The estimation is, however, oblivious of your personal and financial circumstances, so consult a qualified financial planner if you have uncertainties about your retirement planning.

Source: aist.asn.au

If you are planning to have a comfortable retirement income, it's advisable to consult a qualified financial planner to guide you. The information and research on this page is just a guide, and it doesn't consider your personal preferences and financial situation, so it might not be specific to you. There are financial planners in different cities and states, and you can find them using the website menu located at the top of the page.

This website showcases the best Financial Planners in Australia and makes it easy for you to find them. We have listed the Top 10 Financial Planners in each capital city based on our selection criteria.

© 2019. All rights reserved.

Let us help connect you with the

BEST ACCOUNTANT for your needs